Think of marketing intelligence as your company's live, in-car navigation system for the marketplace. It’s the continuous work of gathering and analyzing data from every corner of your business world—from social media buzz to a competitor's latest price drop—so you can make smarter, faster decisions. This constant stream of information turns what would otherwise be random data points into a clear, actionable roadmap for where to go next.

Before we dive deep, here’s a quick overview of what Marketing Intelligence truly entails and why it matters.

Marketing Intelligence At a Glance

| Concept | What It Is | Business Impact |

|---|---|---|

| Competitive Intelligence | Monitoring competitor strategies, product launches, and pricing. | Proactively respond to market threats and capitalize on competitor weaknesses. |

| Market Intelligence | Analyzing broader market trends, economic shifts, and industry dynamics. | Identify emerging opportunities and adapt to market changes before they impact you. |

| Customer Intelligence | Understanding customer behavior, preferences, and feedback. | Personalize marketing, improve customer experience, and increase loyalty. |

| Product Intelligence | Tracking your product’s performance, usage data, and market reception. | Refine your product roadmap, optimize features, and ensure market fit. |

This table just scratches the surface. Now, let’s explore what sets this discipline apart.

What Is Marketing Intelligence, Really?

Imagine you're on a road trip. Market research is like a printed map—it gives you a static, valuable picture of the roads at a specific point in time. Marketing intelligence (MI), on the other hand, is your live GPS.

It’s constantly updating with real-time information about what’s happening on your route:

- Traffic jams (competitor ad campaigns or surprise product launches)

- Weather changes (shifts in market trends or new economic factors)

- Popular destinations (what customers are actually doing and what they need now)

This dynamic view moves you past just looking at historical data. It’s not about what happened last quarter; it’s about what’s happening right now and what’s likely to happen next. By pulling all these different data streams together, MI helps you get ahead of market shifts instead of just reacting to them.

From Guesswork to Guided Decisions

Without a solid intelligence framework, marketing can feel like a series of educated guesses. You launch a campaign hoping it connects, you set prices based on a gut feeling, and you build products you think customers will want. Marketing intelligence swaps that uncertainty for clarity, turning raw data into real strategic direction.

It gives your team the power to answer critical questions with confidence. Which channels are actually giving us the best ROI? What message is hitting home with our target audience? How is our main competitor changing their game plan? Having these answers ready to go is a massive competitive advantage.

Marketing intelligence isn’t just about collecting data. It’s about building a system that turns information into a strategic asset that guides every single decision, from product development to your next big campaign.

The Impact of a Data-Driven Strategy

This shift toward intelligence-led marketing is delivering real, measurable results. A 2023 Statista survey found that 95% of marketing professionals see tangible benefits from data-driven strategies. Specifically, 63% called their efforts "somewhat successful," and another 32% rated them "very successful." It just goes to show how MI cuts down on the guesswork and ties marketing efforts directly to business outcomes. For more context on this, Salesforce.com offers additional insights on the topic.

When you understand the full context of your market, you can put ad spend where it counts, create truly personal customer experiences, and spot new opportunities before anyone else does. For a closer look at how these insights shape customer interactions, check out our guide on what is customer journey analytics.

Ultimately, it’s the difference between finding your way with a compass and navigating with a fully integrated, satellite-guided system.

The Four Pillars of Marketing Intelligence

Think of marketing intelligence as a sturdy table built on four essential legs. Each pillar is a distinct area of focus, and they all need to work together to give you a stable, complete view of your market. If you try to remove one, your whole strategy gets wobbly. But when they're all in place, you’ve got a powerful foundation for making smart decisions.

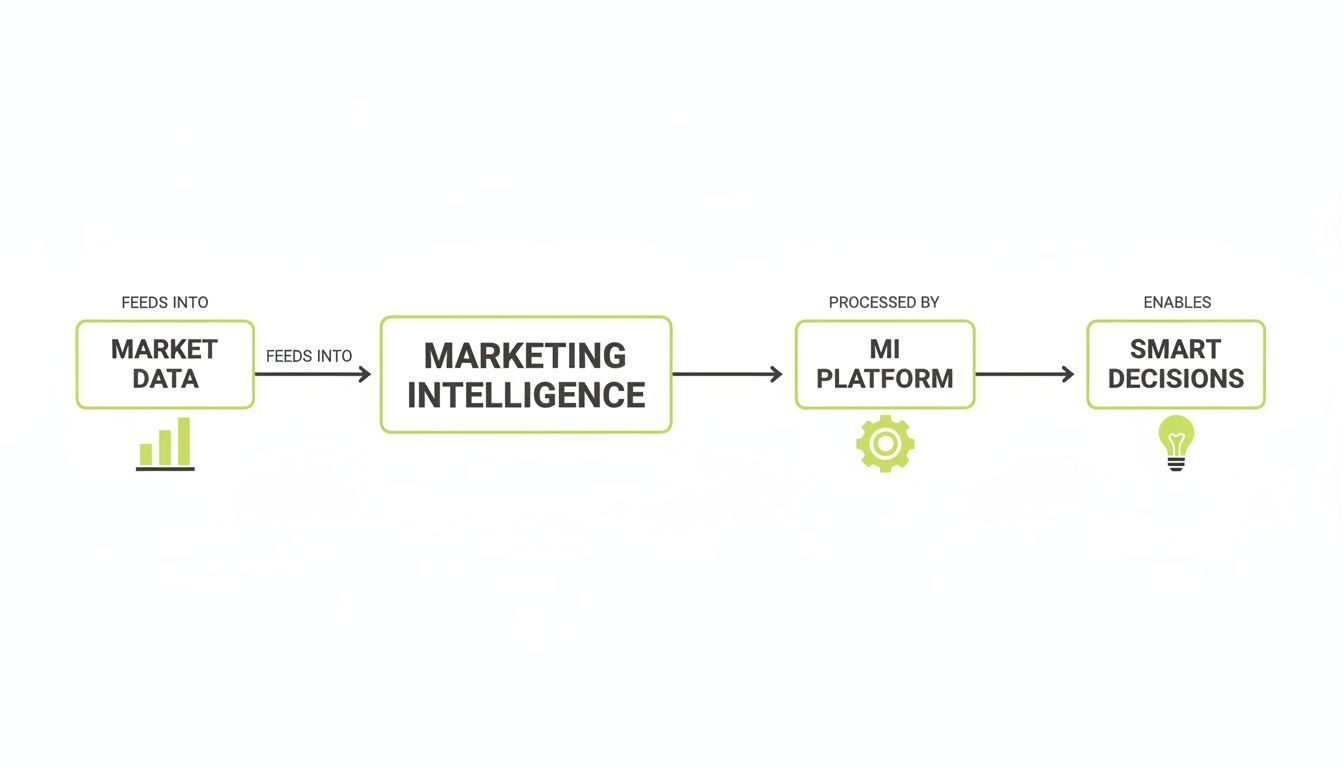

This is all about turning raw data into an actual strategy.

You can see how disconnected pieces of information flow into an MI platform and come out the other side as a real competitive advantage. Technology is what makes this transformation possible.

Competitor Intelligence

The first pillar is Competitor Intelligence. This is the art of figuring out your rivals' next move—sometimes before they even make it. It involves keeping a close eye on their marketing campaigns, pricing changes, new product launches, and even how the public feels about them.

This isn't about corporate espionage. It’s about using publicly available data to build a clear picture of their strengths and weaknesses. For instance, by watching a competitor's social media ads and job postings, you might spot their plan to move into a new market. That insight gives you time to prepare a counter-move, whether that’s doubling down on your current market or launching a competing offer.

Product Intelligence

Next up is Product Intelligence, which is all about your own stuff. This pillar is focused on gathering and analyzing data about how your products are actually used and perceived out in the real world. It means listening to customer reviews, tracking support tickets, and digging into usage data to see which features people love and where they're getting stuck.

Imagine a SaaS company using product intelligence to find out that a rarely used feature is a major headache for its most valuable customers. With that knowledge, the dev team can prioritize a fix, stop customers from leaving, and boost overall satisfaction. This is how you make sure you’re building what people actually want, not just what you think they need.

Marketing intelligence isn't a one-and-done project; it's a continuous cycle. Each pillar feeds the others, creating a constantly updating, 360-degree view of your business environment that fuels smarter strategies and sustainable growth.

Market Understanding

The third pillar, Market Understanding, is where you zoom out to see the bigger picture. This goes beyond just your direct competitors and products. It’s about spotting broader industry trends, economic shifts, new regulations, or emerging technologies that could shake things up. A deep understanding of the market helps you find those golden opportunities for innovation and growth.

For example, a retail brand might notice a growing consumer trend toward sustainable packaging. By jumping on that insight early, they can redesign their products to meet this new demand, getting a huge first-mover advantage and building a stronger reputation with eco-conscious shoppers.

Customer Understanding

Finally, we have the fourth and most critical pillar: Customer Understanding. This is way more than just basic demographics. It’s about digging into the "why" behind what your customers do—their motivations, their needs, and their pain points. This pillar draws on data from your CRM, surveys, social media, and website analytics to build rich, detailed customer personas.

When you understand your customer on this level, you can deliver true personalization. It’s no surprise this has driven incredible results globally: digital marketing channels accounted for 62% of total ad spend in 2025, a figure projected to hit $700 billion by 2026. Plus, intelligent attribution models are already attributing 25% more revenue accurately than older systems.

When all four pillars work together, they create a complete intelligence framework that lets you make proactive, data-informed decisions. If you're looking to get ahead of the curve and forecast what customers will do next, our guide on how digital marketing predictive analytics works is a great place to start.

MI vs Market Research vs Business Intelligence

It’s easy to get marketing intelligence, market research, and business intelligence mixed up. They all revolve around data, after all. But in reality, they play very different roles in a company’s strategy. A great way to think about them is as separate tools for a road trip—each one is essential, but you can’t use one to do another’s job.

Imagine you're gearing up for a big cross-country drive. To make it successful, you need specific information at different stages. Trying to substitute one of these intelligence types for another is like trying to use your paper map to check the fuel gauge. You have the right idea, but you’re using the completely wrong tool.

Market Research: The Snapshot

Think of market research as taking a photograph of a landmark along your route. It’s a static, detailed picture of a very specific subject at a single moment in time. You might run a survey to gauge how customers feel about a new product idea, or maybe you'd hold a focus group to test out ad copy before a big campaign launch.

These activities are incredibly valuable. They deliver deep, specific insights that answer a focused question. But just like a photo, the information it captures is frozen in time. A survey from last quarter won’t tell you how those same customers feel today, especially after your main competitor just launched a killer new feature. Its purpose is to answer a specific, time-bound question.

To get a better handle on this, it's helpful to explore the different types of market research to see how these point-in-time studies can feed into a broader intelligence strategy.

Business Intelligence: The Dashboard

If market research is a photo, then Business Intelligence (BI) is your car’s dashboard. It focuses entirely on what’s happening inside your own vehicle—your internal operations. BI gives you real-time metrics on your performance, answering critical questions like:

- How fast are we going? (Sales velocity)

- How much gas is in the tank? (Marketing budget spend)

- Is the engine running hot? (Customer churn rate)

BI is absolutely essential for monitoring the operational health of your business. It pulls historical and current data from your own systems—sales figures, CRM data, and financial reports—to show you what’s happening right now. It's powerful, but it completely lacks external context. Your dashboard can tell you you're slowing down, but it can't tell you it's because there’s a five-car pile-up a mile ahead. You can always dive deeper into a business intelligence software comparison to see what tools are out there.

Business Intelligence tells you what is happening inside your company. Marketing Intelligence tells you why it's happening by looking at the world outside your company.

Marketing Intelligence: The Live GPS

This brings us to marketing intelligence (MI). If BI is the dashboard, MI is the complete, live-traffic GPS for your entire journey. It’s the game-changer because it syncs your internal dashboard data (BI) with a real-time map of everything happening outside your vehicle.

MI connects your internal performance to the external market landscape, showing you things like:

- Live Traffic: What are competitors doing right now? Which campaign just went live?

- Road Closures: Are new regulations or market shifts about to block your path?

- Points of Interest: What are the emerging customer trends and unmet needs you could target?

At its core, MI is continuous and forward-looking. It combines the "what" from your BI with the "why" from the external world to actively guide your future strategy. This holistic, 360-degree view is what lets you make proactive decisions instead of constantly reacting to surprises.

Comparing Intelligence Types

To really nail down the differences, seeing these three disciplines side-by-side makes everything click. Each has a unique goal, uses different data, and operates on a distinct timeline.

| Attribute | Marketing Intelligence (MI) | Market Research | Business Intelligence (BI) |

|---|---|---|---|

| Primary Goal | Provide a continuous, holistic view of the market for strategic decision-making. | Answer a specific, defined business question at a single point in time. | Report on and analyze internal business operations and performance. |

| Data Sources | External and internal (competitor data, social media, news, CRM, sales data). | Primarily external (surveys, focus groups, interviews). | Primarily internal (sales data, financial records, ERP, CRM). |

| Time Focus | Future-oriented (predictive and prescriptive). What's next? | Past-oriented (descriptive). What happened? | Present-oriented (descriptive). What's happening now? |

| Scope | Broad and ongoing, covering the entire market ecosystem. | Narrow and project-based, focused on a specific query. | Internal and operational, focused on company performance. |

Looking at the table, it’s clear that these aren't competing concepts—they’re complementary. Strong market research projects feed into your MI, and your BI provides the internal health check needed to act on external opportunities. You truly need all three to navigate the market successfully.

How Marketing Intelligence Drives Real Results

Theory is one thing, but seeing how marketing intelligence actually fuels business growth is what really matters. This is where we move from the whiteboard to the real world, turning concepts into solutions that solve tough problems and create measurable value. It’s all about transforming a constant stream of data into decisive actions that pad the bottom line.

Instead of just passively collecting information, marketing intelligence actively steers your strategy. It gives you the context needed not only to understand what happened yesterday but to confidently decide what to do tomorrow. Let's look at a few practical examples that show MI in action.

Dynamic Pricing and Competitor Response

Picture a cutthroat e-commerce market where a big retailer wants to crush its holiday sales goals. The challenge? Stay competitively priced without kicking off a race to the bottom that destroys their profit margins.

Using marketing intelligence, they set up automated systems to watch key competitors' pricing in real-time. But the MI platform goes deeper than just tracking prices; it analyzes competitor stock levels, promotional calendars, and even social media buzz around their sales events. When a top rival drops a flash sale, the system instantly pings the pricing team.

Instead of a panicked, reactive price slash, their MI platform serves up a calculated recommendation. It might suggest a price match on a few key items while also bundling a higher-margin accessory—an offer designed to protect profitability while still catching the shopper's eye. The outcome was a 15% jump in sales for targeted categories and a 5% boost in overall profit margin compared to the previous year's reactive approach.

Product Roadmap and Feature Prioritization

Think about a growing SaaS company that's struggling to figure out which new features to build. The developers have a laundry list of ideas, the sales team has their own requests, and customer support is flagging the same common issues over and over. Without a single source of truth, the product roadmap is driven by the loudest person in the room, not necessarily by the most critical business need.

This is where marketing intelligence cuts through the noise. By pulling in data from all over, the company gets the full story:

- Product Analytics: It turns out 80% of users only use four out of fifteen features. That's a huge sign to either simplify the product or beef up its core functionality.

- Support Tickets: A specific workflow issue is the root cause of 30% of all customer complaints.

- Social Listening: The team uncovers conversations where potential customers are raving about a competitor's unique integration feature.

- Customer Surveys: Existing clients say they'd gladly pay more for better reporting tools.

Armed with this 360-degree view, the product team can prioritize with confidence. They decide to squash the workflow bug first to stop customer churn, then build the requested reporting tools to create a new premium tier, boosting the average revenue per user. For marketers, exploring how AI Market Intelligence can provide an edge in scenarios like this is a game-changer.

Marketing intelligence transforms decision-making from an opinion-based debate into an evidence-guided process. It weaves what customers are saying, what competitors are doing, and how your product is performing into a single, actionable story.

Ad Spend Optimization and Personalization

A direct-to-consumer brand is pumping money into digital ads across several platforms but has no real idea which channels are actually driving sales. Their attribution model is basic, giving equal credit to every touchpoint, which makes optimizing their ad spend feel like guesswork.

By bringing in a marketing intelligence solution, they connect their ad platform data with their CRM and website analytics. This creates a unified map of the entire customer journey, from the very first ad impression all the way to the final purchase.

The platform's analysis uncovers some gems. While Facebook ads generate a lot of initial buzz, it's Google Shopping ads that are responsible for 60% of the final conversions. It also shows that customers who watch a specific video ad on YouTube end up having a 40% higher lifetime value.

With these insights, the marketing team gets to work. They reallocate their budget, pulling funds from top-of-funnel awareness campaigns on weaker platforms and pushing them into their high-converting channels. They also whip up personalized retargeting campaigns for that high-value YouTube audience. This strategic shift leads to a 25% reduction in customer acquisition cost and a 20% increase in marketing ROI in just one quarter. To get this right, you have to be tracking the right digital marketing performance metrics.

Building Your Marketing Intelligence Strategy

Turning a mountain of raw data into a real strategic asset doesn’t just happen. It takes a deliberate, structured plan. Building an effective marketing intelligence (MI) strategy is a lot like assembling a high-performance engine; every part has to be chosen carefully, installed correctly, and tuned to work perfectly with all the others.

This blueprint will walk you through the essential steps for creating a powerful MI function from the ground up. The idea is to get past just collecting data and start actively using it to steer your business forward. It's a methodical process that kicks off not with fancy technology, but with fundamental business questions.

Define Your Strategic Questions

Before you even glance at a data source or a piece of software, you have to start with "why." What are the critical questions that, if you could answer them, would make the biggest difference to your business? Vague goals like "we need to understand our customers better" just won't cut it. You need to get specific.

Think of it like telling your GPS exactly where you want to go. "Drive north" is pretty useless. But "find the fastest route to 221B Baker Street, avoiding tolls" is a command it can actually work with.

Your strategic questions need to be just as precise:

- Which of our marketing channels are bringing in the most qualified leads for the new SaaS product?

- What are the top three features our most profitable customers keep asking for?

- How does our main competitor's pricing shift during a big holiday sale?

- What's the number one reason customers cancel within their first 90 days?

These sharp, focused questions give your entire strategy direction. They tell you what data you need to find, which tools will be useful, and how you’ll know if you're succeeding.

Identify and Connect Your Data Sources

Once your strategic questions are locked in, the next job is figuring out where the answers are hiding. This means mapping out all your potential data sources, both inside and outside your company. A lot of businesses are sitting on a goldmine of information—it’s just disconnected and scattered everywhere.

The real challenge in modern marketing isn't a lack of data; it's that all the data is stuck in silos. An effective marketing intelligence strategy is all about breaking down those walls so information can flow freely and create a single, clear picture.

Your data inventory will probably include a mix of sources like these:

- Internal Data: Your CRM (customer interactions), ERPs (sales figures), product analytics (user behavior), and website analytics are great places to start.

- External Data: Think social media listening tools (brand sentiment), competitor monitoring services (pricing, ad campaigns), market research reports (industry trends), and even public APIs.

The big technical lift here is connecting these different sources. This usually involves using APIs, data connectors, or a Customer Data Platform (CDP) to pull everything into one central place. Once it's all together, you can clean it up, standardize it, and get it ready for analysis.

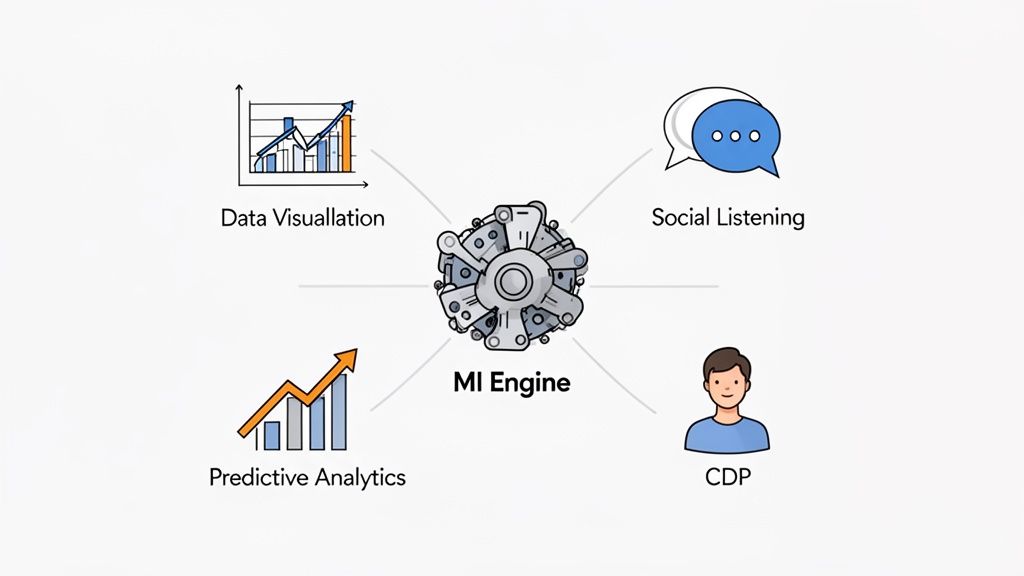

Select the Right Tools for the Job

Now that you know what data you need and where it lives, you can pick the right tech to make sense of it all. The market is flooded with tools, but they mostly fall into a few key categories. Your choices should be driven entirely by your strategic questions and your budget.

Key Tool Categories

- Data Visualization: Tools like Tableau or Google Looker Studio are fantastic for turning dense spreadsheets into interactive dashboards that make trends and patterns jump out.

- Social Listening: Platforms such as Brandwatch or Sprout Social keep an ear to the ground, monitoring social media conversations to track brand sentiment and see what competitors are up to.

- Analytics & BI Platforms: This bucket includes everything from Google Analytics to more sophisticated business intelligence tools that help you analyze performance across your own digital properties.

- Predictive Analytics: This is more advanced stuff. This kind of software uses your historical data to forecast what might happen next, like identifying which customers are most likely to churn.

It's smart to start small. You don't need a massive, enterprise-level software suite on day one. Begin with the tools that answer your most urgent strategic questions and then build out your tech stack as your MI function grows. The right tools should make things simpler, not add another layer of complexity.

The Modern Marketers MI Toolkit

A powerful marketing intelligence strategy is nothing without the right technology to turn raw data into a real competitive edge. Think of this toolkit less like a list of software and more like the specialized instruments a doctor uses to diagnose market health, understand customer needs, and prescribe the perfect campaign.

Each tool has a specific job, and when they work together, they create a powerful engine for smarter, faster decisions. This is where the abstract idea of what is marketing intelligence gets real and becomes part of your day-to-day work. Let's break down the essential tools that form the bedrock of any modern MI tech stack.

Data Visualization Platforms

Staring at a spreadsheet full of raw data is like trying to read a story written in a language you don't understand. Data visualization platforms like Tableau or Google Looker Studio are your universal translators. They transform endless rows and columns of numbers into intuitive charts, graphs, and interactive dashboards.

This simple switch allows marketers to spot trends, pick out anomalies, and share complex findings in a single glance. Instead of just telling your team, "Q3 sales are up," you can show them a trend line that makes the growth obvious, making the insight immediately understandable and much more impactful.

Social Listening Tools

The digital world is one massive, non-stop focus group, and social listening tools like Brandwatch are your ears to the ground. These platforms constantly scan conversations across social media, forums, and news sites to track brand sentiment, spot emerging trends, and keep a close eye on what your competitors are up to.

By tuning into what real people are saying, you can gauge the public's reaction to a new product launch, catch a potential PR crisis before it blows up, or even uncover unmet customer needs you never knew existed. It gives you an unfiltered view straight from the market itself.

A complete MI toolkit doesn't just show you what is happening with your internal metrics; it connects those numbers to the why by revealing the external forces—competitor actions, customer sentiments, and market shifts—that are driving them.

Predictive Analytics Software

If data visualization shows you what happened and social listening tells you what's happening now, then predictive analytics is your crystal ball for what will happen next. This type of software digs into your historical data, using machine learning algorithms to find patterns and forecast future outcomes.

For example, it can analyze past customer behavior to flag which leads are most likely to convert or which current customers are at risk of churning. This forward-looking view lets you stop reacting and start being proactive, putting your resources behind the opportunities with the highest chance of success.

Customer Data Platforms (CDPs)

A Customer Data Platform (CDP) acts as the central nervous system for all your marketing intelligence. It pulls in data from all your different touchpoints—your CRM, website, email platform, and social channels—and stitches it all together to create a single, unified profile for every single customer.

This 360-degree view is the key to true personalization and effective cross-channel marketing. By tracking metrics like ad spend, conversions, ROI, and ROAS across every platform, marketers finally get complete visibility. This is absolutely critical, especially when multi-channel campaigns are known to drive 3.8x higher engagement rates. You can explore the data on Improvado.io to see how these MI metrics make a difference. Building this unified view ensures every part of your marketing stack is working from the same playbook.

Frequently Asked Questions About Marketing Intelligence

Diving into marketing intelligence is exciting, but it naturally brings up questions about the practical side of things—like budgets, implementation headaches, and how to prove it’s actually working. Getting straight answers to these questions is the first step toward building a strategy that works.

We’re going to tackle some of the most common questions businesses ask when they first start pulling back the curtain on marketing intelligence. Think of this as the bridge between knowing the concept and actually putting it into action.

How Can a Small Business Start with MI on a Limited Budget?

You don’t need a massive budget to get started with marketing intelligence. Far from it. Small businesses can make huge strides by simply tapping into the data they already have and using free or low-cost tools to find those first game-changing insights. It’s all about being resourceful and focusing on what moves the needle.

Instead of jumping to expensive enterprise software, here are a few accessible places to start:

- Dig Into Free Analytics: Tools like Google Analytics and the native analytics in your social media accounts are bursting with valuable data. Start there. Analyze how people behave on your site and which content actually gets them to engage.

- Unlock Your CRM Data: Your Customer Relationship Management (CRM) system is a goldmine. Look at purchase histories, customer feedback, and communication logs. You'll quickly see patterns that identify your most valuable customers and what they really want from you.

- Track Competitors Manually: You don't need fancy software to keep an eye on the competition. A little old-fashioned observation goes a long way. Subscribe to their newsletters, follow them on social media, and monitor their pricing. This alone provides plenty of actionable intelligence.

What Are the Biggest Challenges of Implementing an MI System?

Putting a marketing intelligence system in place does have its hurdles, but they're completely manageable if you plan ahead. The biggest challenges are rarely just technical—they usually come down to data, people, and processes. One of the most common roadblocks is data silos. This is where crucial information gets trapped in different departments like sales, marketing, and customer service, making it impossible to get a single, clear picture of your business.

Another big one is the skills gap. Turning raw data into a real strategy requires a specific kind of expertise that you might not have in-house. This often means you’ll need to either train your current team or bring in analysts who can bridge that gap. Finally, you can't overlook cultural resistance. If your company isn't used to making decisions based on data, you might face some pushback, which is why getting buy-in from leadership right from the start is non-negotiable.

How Do You Actually Measure the ROI of Marketing Intelligence?

Measuring the return on investment (ROI) of marketing intelligence isn't just a "nice-to-have"—it's essential for proving its value and keeping the momentum going. The idea is to draw a straight line from your MI activities to real, tangible business results. It’s how you shift the conversation from, "Look at all this data we have!" to "This data helped us achieve X."

The true measure of marketing intelligence isn't the volume of data you collect, but the value of the decisions it enables. By tracking specific metrics, you can draw a clear line from insight to impact.

To nail down your ROI, you need to focus on metrics that tell a clear before-and-after story. Here’s what to track:

- Improved Customer Acquisition Cost (CAC): Show exactly how your insights led to more efficient ad spending and a lower cost to bring in each new customer.

- Increased Customer Lifetime Value (CLV): Demonstrate how a deeper understanding of customer behavior helped you create better retention strategies, directly leading to a higher CLV.

- Higher Marketing Campaign Conversion Rates: Track how MI-driven tweaks to your targeting, messaging, or channel mix directly boosted the performance of your campaigns.

By keeping a close eye on these key performance indicators, you can put a real dollar amount on the impact of your marketing intelligence efforts.

At Magic Logix, we specialize in turning data from a simple resource into your most powerful strategic asset. Our expertise in predictive analytics and business intelligence can help you build an MI framework that drives real growth, no matter your size. Discover how we can help you make smarter, data-driven decisions.